AI Investment: Capital Trends, Strategies & Challenges

Advertisements

The recent affection for innovation in China, particularly marked by the advent of DeepSeek, has sent shockwaves through Silicon Valley. This surge of interest in artificial intelligence (AI) has sparked a wave of panic among tech giants and cast doubts on the explosive spending strategies embraced by companies on Wall Street. What began as a $500 billion interstellar project spearheaded by OpenAI founder Sam Altman has escalated into a larger push, targeting an ambitious goal of achieving a staggering $5 trillion computational cluster in the near future.

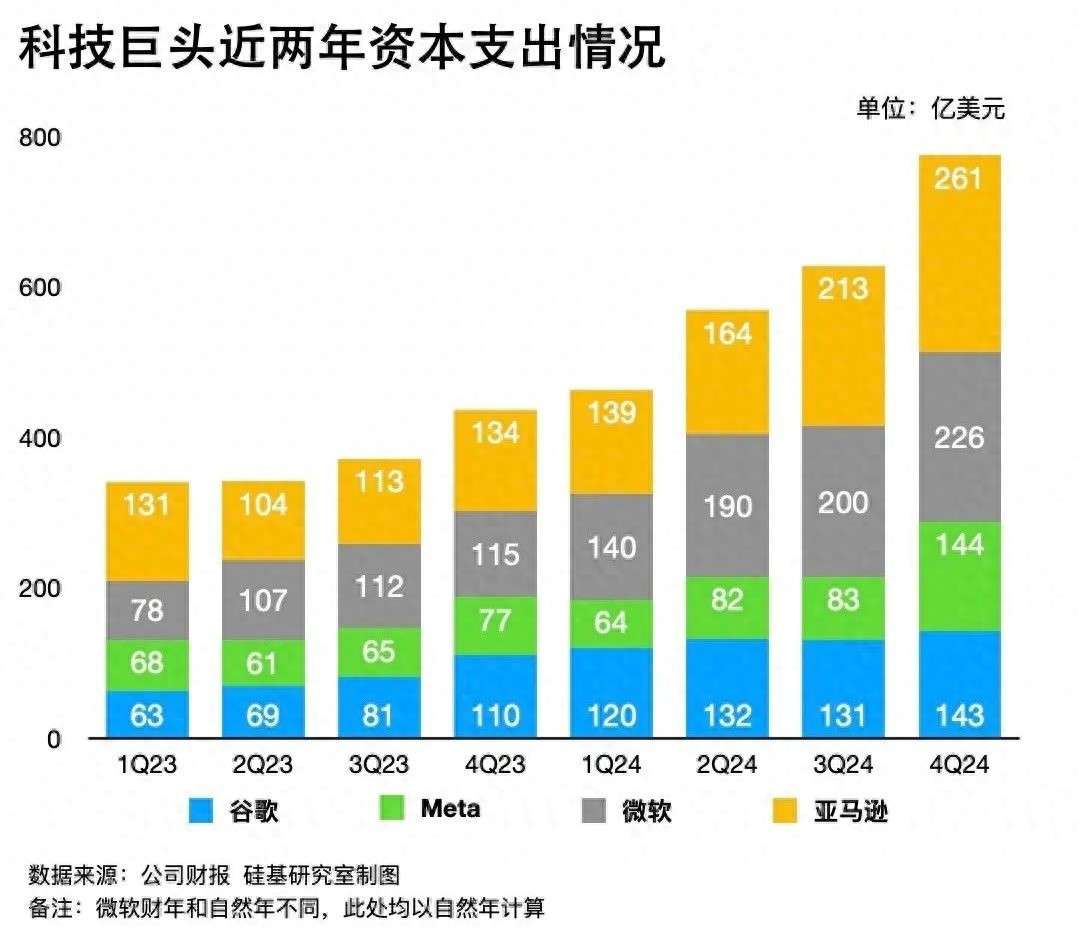

According to the Silicon Valley Research Lab, 2024 is set to witness four of the biggest tech firms — Amazon, Microsoft, Alphabet (the parent company of Google), and Meta — collectively investing over $240 billion in capital expenditures (CAPEX), with expectations to exceed $320 billion by 2025 based on guidance provided during earnings calls. This relentless spending on AI-related services outlines a broader trend in the technology sector, revealing a clear trajectory of increasing investments.

Looking back to 2023's second quarter, it is evident that the capital expenditures for tech behemoths like Microsoft, Meta, Amazon, and Google began a substantial upward trend. Analyzing their capital intensity, or the amount of capital expenditure relative to total revenue, it appears that this figure might reach 17.2% in 2024, surpassing even the last cycle of significant investments by major energy firms during the oil price boom between 2012 and 2016, when the oil industry allocated just 10.2% of their revenue into capital investments.

As these corporations amplify their spending, questions continue to arise about where the funds are flowing, who is taking the most aggressive stance, and whether they can feasibly curb their financial commitments. Further analysis of their expenditures reveals some notable trends in capital flow dedicated to AI infrastructure.

The story of Musk’s Colossus AI training cluster is emblematic of the direction in which these funds are flowing. In July 2024, Musk shared on platform X that he transformed a conventional appliance factory into the world's most potent AI training cluster within a mere 122 days. This colossal facility boasts an impressive aggregation of 100,000 H100 chips and signifies a monumental achievement even by NVIDIA’s standards, with founder Jensen Huang commenting on the superhuman speed of its realization.

The expenditure on capital assets primarily involves investments in fixed assets, including land, buildings, and equipment, essential for ongoing AI investments. For tech giants, capital expenditures extend towards vital components like AI chips, servers, networking, and storage solutions, essentially crafting a heavily asset-oriented business model.

A considerable portion of their expenditures is also allocated to upgrading and maintaining software and content ecosystems, as these firms often opt for a hybrid strategy that combines hardware with software. Microsoft, Amazon, Google, and Meta have consistently increased their capital expenditures with a pronounced focus on expanding their data center capabilities. Semi Analysis founder Dylan Patel recently noted that the market often underestimates these companies' spending on data center capacity.

As explored by industry experts, the primary costs associated with data centers include hardware purchases and daily operational expenses like rent and utilities, along with personnel costs, where the bulk of investments are again focused on AI chips. Notably, Goldman Sachs asset management investment manager Sung Cho highlighted that cloud providers allocate nearly half of their capital expenditures to acquiring NVIDIA chips. Market research firm Omdia has also pointed out that leading tech firms are still the largest buyers of NVIDIA's flagship Hopper chips, with Microsoft purchasing 485,000 units last year alone, followed by Meta with 224,000. The CFO of NVIDIA, Colette Kress, indicated during CES that demand for the latest Blackwell GPU chips remains outstripped by supply, further bolstering predictions of robust growth for NVIDIA’s data center business.

Nevertheless, understanding the tech giants’ race for AI infrastructure involves more than sheer figures. It is essential first to acknowledge that Microsoft, Meta, Amazon, and Google possess high cash flows and robust balance sheets, allowing them to undertake such massive expenditures. Furthermore, contrary to external perceptions of unrestrained spending, these companies are, in fact, exploring ways to trim costs wherever viable amidst their extensive investments in AI infrastructure.

Efforts to develop proprietary chips, extend the depreciation period of servers, and collaborate with energy companies reveal a strategic intention to effectively allocate resources while enhancing computational efficiency and preserving profit margins. Meta's executives recently confirmed an adjustment in the expected lifespan of certain servers and network assets from 4-5 years to an extended 5.5 years. Alongside these developments, the industry behemoths are also heavily investing in the emerging trend of developing ASIC chips for specific applications, positioning them to find alternative solutions over the long haul.

Analyzing who among the tech giants is embracing a more aggressive versus a conservative approach reveals a telling breakdown. Collectively, these four leading companies are navigating this investment landscape with varied methods and attitudes towards capital spending. Summarily, Meta stands out as the most aggressive, followed by more neutral players like Microsoft and Google, while Amazon adopts a more cautious stance.

Meta's capital expenditure surged nearly twentyfold compared to a decade ago, outpacing cloud rivals. In 2025, the company is set to allocate between $60 billion to $65 billion towards advancing its AI capabilities, with CEO Mark Zuckerberg demonstrating his commitment to harnessing the AI future. This major investment is driven primarily by a strategic pivot in Meta's business model, focusing on enhancing advertising efficiency primarily tied to social media traffic — a stark ongoing challenge with its VR-related Reality Labs division still operating at a loss.

In contrast, Microsoft, Amazon, and Google, with their established cloud operations, effectively leverage AI to scale their existing businesses, optimally distributing relevant costs to maintain profitability. In comparison, Meta’s singular reliance on augmenting user and advertiser engagement through AI makes this investment critical for its ongoing viability.

When contrasting their capital expenditure growths, it becomes evident that while Microsoft and Google have steadily maintained higher rates of investment in recent years, Amazon’s CAPEX significantly spiked only in the second quarter of 2024. Amazon's conservative spending approach can be attributed to two primary factors: leading the cloud market for an extended timeframe with a steady 30% market share, and its preference for primarily internal development regarding capital allocation.

To illustrate, Amazon’s decade-long investment in developing proprietary chips has recently yielded partnerships for their own AI-powered clusters leveraging these in-house technologies, reinforcing their long-term strategy of building a robust supply chain.

The conversation surrounding the technology giants' substantial investments in AI has sparked diverging opinions reflective of the underlying “Jevons Paradox.” While critics express concern that the ongoing AI arms race may devolve into an expensive gamble, especially with DeepSeek's proven cost-efficient methodologies to achieve equivalent results, others maintain that fundamental competition for computational resources remains both necessary and salient.

Proponents argue that AI usage efficiency, resulting from breakthroughs like DeepSeek, can galvanize a surge in applications, and along with the Jevons Paradox, illustrate that as the usage rates of AI increase, so too will the demand across sectors. This notion implies that “AI will become an eternally insatiable commodity.” Microsoft CEO Satya Nadella articulates this viewpoint, underscoring how heightened efficiency stemming from AI investments may yield unforeseen increases in demand.

However, skeptics don't overlook the implications either; they seek a clearer timeline connecting AI spending with tangible profits and sales growth, rather than just broad promises. In their inquiries, investors desire concrete plans for when expenditures will directly translate into financial returns.

Yet, like many unforeseen events — such as the emergence of DeepSeek itself — the tech giants may struggle to establish specific timelines. Zuckerberg himself acknowledged the evolving nature of capital investments in competitive environments, expressing that "it might be too early to draw conclusions” about their current trajectories, admitting uncertainty regarding which phase of this cycle their companies are currently navigating.

The technologic giants are caught in a paradox of their own making: grappling between insatiable market expectations rooted in fear of missing out (FOMO) and the need to stake their claim in the future of AI innovation. Historical evidence also suggests that during previous technology competitive cycles, companies willing to expand often reaped favorable rewards.

As Google CEO Sundar Pichai aptly summarizes, the risk associated with underinvestment in AI poses far greater dangers than over-investment. However, it is evident that such intense capital outlays cannot maintain sustainability indefinitely. Persistent high expenditures could jeopardize profitability, adversely affecting tech companies that have long sustained high cash flows. Signals from quarterly earnings calls reflect a recognition of this impending transition, with Amazon foreseeing that issues related to chip supply chains and electricity constraints will start to ease by late 2025.

As Sam Altman hearkens to an “incredible new game of computational efficiency” in 2025, this ongoing dynamic will necessitate careful observation. The nuanced interplay of these capital expenditures reveals a simultaneous push towards efficiency and rationality amongst the tech behemoths, navigating the ever-evolving landscape of AI.

Leave a Reply

Your email address will not be published. Required fields are marked *